AI Due Diligence for Private Equity

Private equity runs on information asymmetry. The firm that understands a target better, faster, and more comprehensively than competitors wins the deal. The firm that can synthesize learnings across 50 portfolio companies identifies operational improvements others miss.

This is precisely why AI adoption in PE presents a paradox: the technology that promises the greatest competitive advantage also creates the greatest information risk.

This guide addresses how PE firms can deploy AI-powered knowledge systems for deal origination, due diligence, and portfolio intelligence—while maintaining the confidentiality that the industry demands.

The PE Knowledge Architecture Problem

Information Categories in a Typical PE Firm

Deal Pipeline Intelligence

- Proprietary deal sourcing (inbound and outbound)

- Management meeting notes and assessments

- Preliminary valuations and investment theses

- Competitive intelligence on other bidders

Due Diligence Documentation

- Financial models and sensitivity analyses

- Quality of Earnings (QoE) reports

- Commercial due diligence findings

- Legal and regulatory review documentation

Portfolio Company Intelligence

- Board meeting minutes and resolutions

- Operating metrics and KPI dashboards

- Management team assessments

- Value creation initiatives and outcomes

Institutional Knowledge

- Investment committee deliberations (IC memos)

- Post-mortem analyses on exits

- Sector expertise and thesis development

- LP relationship history and preferences

The Current State: Fragmented and Unqueried

Across most PE firms, this knowledge exists in disconnected systems:

| System | Knowledge Type | Accessibility |

|---|---|---|

| Deal correspondence, advisor communications | Full-text search only | |

| SharePoint/Dropbox | Due diligence documents, IC memos | Folder-based navigation |

| CRM (Salesforce/DealCloud) | Contact records, deal tracking | Structured queries only |

| Portfolio dashboards | Operating metrics | Current state only |

| Partner memory | Sector expertise, relationship history | Ephemeral |

The result: junior team members spend 15-20 hours per deal searching for relevant precedents. Partners hold critical context that is never institutionalized. When a senior partner exits, decades of pattern recognition leave with them.

Why Public AI Fails in PE Contexts

The Deal Room Constraint

Consider a typical due diligence scenario:

A PE firm is bidding on a manufacturing company. They need to:

- Analyze 2,000 pages of data room documents

- Compare findings against 3 similar acquisitions they completed

- Identify red flags based on sector patterns

- Prepare IC memo with investment recommendation

Using ChatGPT or Claude would require uploading:

- Target company financials (breach of data room confidentiality)

- Prior acquisition documentation (exposure of portfolio company data)

- Investment committee precedents (disclosure of internal decision-making)

This is not a theoretical concern. Most data room NDAs explicitly prohibit uploading documents to third-party AI services. A single violation could terminate deal access and expose the firm to legal liability.

The Competitive Intelligence Risk

PE firms guard their investment theses as core intellectual property. A query like:

"Based on our analysis of the automotive aftermarket sector, what valuation multiple should we expect for a roll-up strategy?"

This reveals:

- Sector focus and thesis development

- Acquisition strategy and approach

- Valuation parameters and expectations

Routed through a public AI provider, this becomes potential competitive intelligence leakage.

The LP Fiduciary Dimension

Limited Partners increasingly require disclosure of AI usage and data handling practices. A PE firm using public cloud AI for portfolio analysis may face:

- LP due diligence questions about data security

- Potential breach of confidentiality representations

- Regulatory scrutiny in jurisdictions with data localization requirements

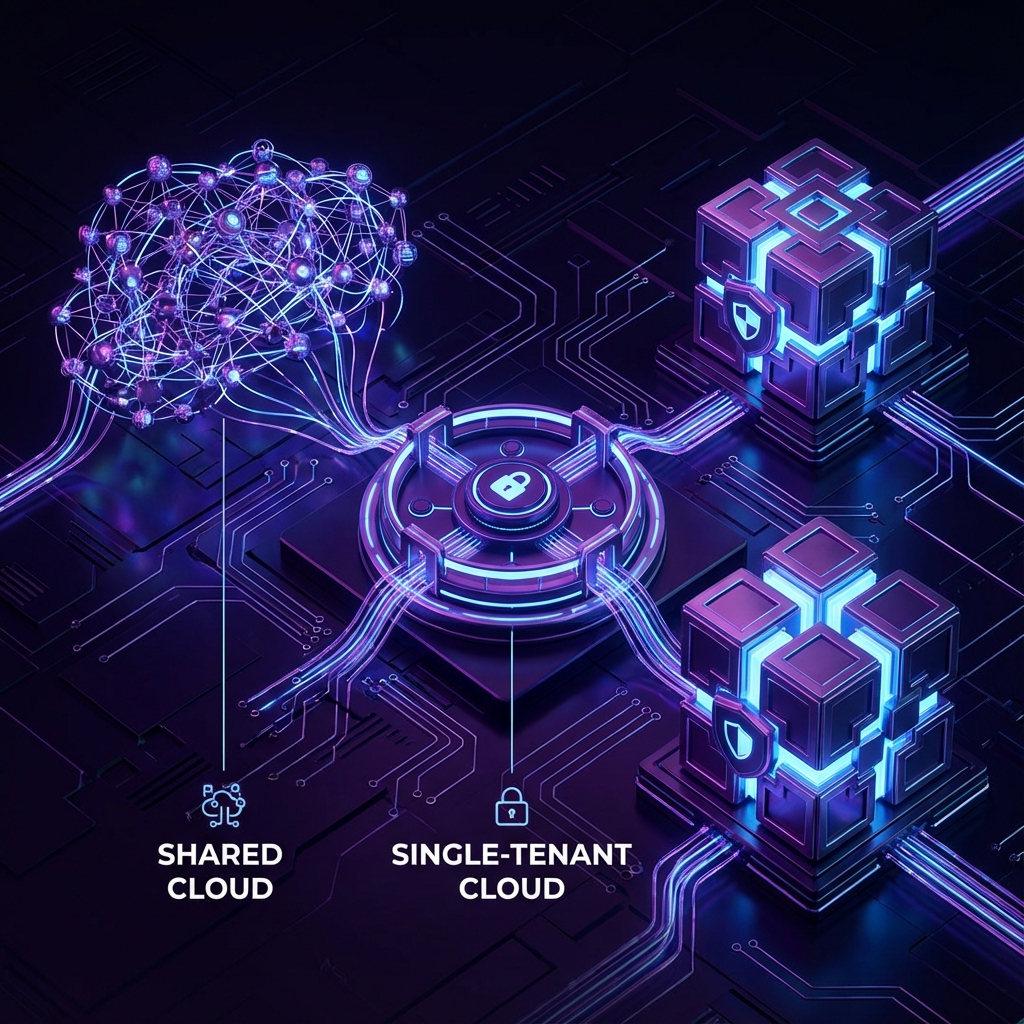

Sovereign Architecture for PE Firms

Deployment Requirements

For PE use cases, sovereign AI must provide:

- Data Room Isolation: Separate knowledge spaces per transaction

- Cross-Deal Intelligence: Ability to query across historical deals (with appropriate access controls)

- Temporal Versioning: Distinguish between diligence findings at signing vs. current portfolio knowledge

- Multi-Party Access: Controlled access for deal teams, advisors, and portfolio company management

- Audit Trail: Complete logging for compliance and internal review

Architecture Patterns

Pattern 1: Transaction-Specific Deployment

For mega-deals requiring maximum isolation:

- Dedicated compute instance per transaction

- Teardown after deal close or termination

- No cross-deal knowledge bleeding

Pattern 2: Firm-Wide Knowledge Platform

For institutional memory and pattern recognition:

- Persistent knowledge base across all transactions

- Zoned access by deal, portfolio company, and user role

- Longitudinal analysis capabilities

Pattern 3: Hybrid Approach

Most PE firms benefit from both:

- Firm-wide platform for institutional knowledge

- Transaction-specific instances for active deals

- Controlled migration from deal instance to firm platform post-close

Technical Specifications

Compute Requirements:

- 16 vCPU, 64GB RAM minimum per deal instance

- Azure OpenAI via private endpoints (Singapore/EU based on data residency requirements)

- GPU allocation for document processing (OCR, table extraction)

Storage Architecture:

- Vector database per transaction namespace

- Encrypted object storage for source documents

- Separate backup infrastructure with key management

Access Control:

- Deal-level permission groups

- Time-based access expiration (advisor access ends at transaction close)

- IP whitelisting and Zero Trust network access

Implementation: The PE RAG Stack

Document Processing Pipeline

PE documentation presents specific challenges:

Data Room Documents:

- Inconsistent formatting (scanned documents, spreadsheets, contracts)

- Table-heavy financial data

- Multi-file relationships (operating agreement + amendments)

Processing Requirements:

- High-fidelity OCR for scanned documents

- Table extraction and structure preservation

- Document relationship mapping

- Metadata extraction (author, date, version)

Knowledge Retrieval for Due Diligence

Due diligence queries require specialized retrieval:

Precision Requirements:

- "What is the revenue recognition policy?" must retrieve the specific accounting policy, not general references to revenue

- "List all change of control provisions" requires scanning across all contracts in the data room

Cross-Reference Queries:

- "How does this EBITDA adjustment compare to the XYZ deal we did in 2023?"

- "What concerns did we have about similar customer concentration in prior deals?"

Red Flag Detection:

- Identify warranty and representation exceptions

- Flag unusual contract terms against market precedent

- Highlight revenue quality concerns based on pattern matching

Query Patterns by Use Case

Deal Sourcing:

- "What management teams have we met in the industrial services sector in the past 12 months?"

- "Which portfolio companies have adjacency with water treatment?"

- "What is our thesis on healthcare services consolidation?"

Due Diligence:

- "Summarize all customer contracts with revenue over $1M"

- "What are the key findings from the QoE report?"

- "List all pending litigation matters"

Portfolio Intelligence:

- "Which portfolio companies have implemented the pricing optimization playbook?"

- "What operational improvements drove margin expansion in our manufacturing exits?"

- "Compare board-approved budgets vs. actuals across the portfolio"

IC Preparation:

- "What concerns have we historically raised about family-owned businesses?"

- "How did we structure earnouts in prior healthcare deals?"

- "What was the investment committee's perspective on similar customer concentration?"

Security and Compliance Architecture

Data Room Confidentiality

Compliance with data room obligations requires:

- No External Data Transmission: All processing occurs within controlled infrastructure

- Document-Level Audit: Every access logged with user, timestamp, and purpose

- Timed Access Expiration: Deal documents inaccessible after transaction terminates

- Secure Deletion: Cryptographic erasure upon project close

LP Reporting Readiness

For LP due diligence, PE firms should be able to demonstrate:

- Data residency and sovereignty controls

- Independence from public AI providers

- Audit logs available for inspection

- Incident response procedures for potential breaches

Regulatory Considerations

Singapore (MAS)

- Technology risk management guidelines apply to PE fund managers

- Data localization requirements for certain data categories

EU (GDPR)

- Data processing agreements required for any EU personal data

- Cross-border transfer restrictions

US (SEC)

- Record-keeping requirements for communications

- Examination readiness for AI usage

Case Study: Mid-Market PE Implementation

Context

- $2B AUM mid-market PE firm

- 8 portfolio companies

- 50+ deals evaluated annually

- Junior team burnout on precedent research

Deployment

- Firm-wide sovereign platform (Singapore private cloud)

- Transaction-specific deal instances

- Integration with DealCloud for pipeline data

- 10,000+ documents ingested from prior transactions

Results (First Year)

- Due diligence timeline reduced by 30% (8 weeks → 5.5 weeks)

- Junior analyst hours on precedent research: -60%

- IC memo preparation time: -40%

- Cross-portfolio insight queries: 200+ monthly (previously near-zero)

Key Learning

The highest-value queries were cross-deal pattern recognition:

- "Show me all pricing power assessments from consumer deals"

- "What operational issues did we discover post-close that we missed in diligence?"

- "Which add-on acquisitions delivered above-thesis returns?"

These queries were previously impossible without partner memory or exhaustive document review.

Getting Started

Phase 1: Knowledge Inventory (Week 1)

- Audit existing document repositories

- Classify by transaction vs. institutional knowledge

- Identify integration requirements with deal tracking systems

Phase 2: Pilot Transaction (Week 2-3)

- Deploy deal instance for active or recent transaction

- Ingest data room documents and IC materials

- Test queries with deal team

Phase 3: Firm-Wide Platform (Week 4-6)

- Deploy persistent knowledge base

- Define access control architecture

- Establish ingestion workflows for ongoing deals

Phase 4: Portfolio Integration (Month 2-3)

- Connect portfolio company reporting

- Enable cross-portfolio analysis

- Train investment team on advanced queries

Next Steps

For PE firms evaluating sovereign AI infrastructure:

- Security Review: Architecture documentation for your IT and compliance teams

- Deal Room Compliance: Legal review of AI usage under typical data room terms

- Pilot Scope: Identify 2-3 recent transactions for initial deployment

Schedule Architecture Review | Explore Private Cloud Pilot

Related reading: