The $100B Sovereign AI Surge

In 2025, sovereign AI emerged from policy discussions into actual infrastructure investment. By 2026, global spending on sovereign AI infrastructure is projected to reach $100 billion—a dramatic acceleration driven by geopolitical realities and enterprise compliance requirements.

For CIOs and CTOs planning knowledge infrastructure, this shift is not abstract. It directly impacts vendor selection, architecture decisions, and long-term technology strategy.

The Market Shift

Investment Scale

2026 Projections:

- Global AI capital expenditure: $480 billion

- Sovereign + Enterprise AI: 17% of total ($82B)

- National GPU infrastructure programs: $100B+ committed

Key Investments:

- EU AI Factories Initiative: €10B+

- Singapore National AI Strategy 2.0: Additional compute capacity

- Middle East sovereign cloud buildouts: $30B+ committed

- APAC regional data center expansion

What's Driving the Surge

Geopolitical Factors:

- US-China technology decoupling

- Data localization regulations proliferating globally

- Concerns about AI supply chain dependencies

- National security considerations for critical infrastructure

Enterprise Factors:

- Regulatory compliance mandates (GDPR, PDPA, etc.)

- Customer requirements for data residency

- IP protection and trade secret concerns

- Supply chain risk mitigation

The "Geopatriation" Trend

A new term is entering enterprise vocabulary: geopatriation—the deliberate relocation of workloads to sovereign or local infrastructure.

Unlike cloud migration, geopatriation prioritizes:

- Jurisdictional control over operational efficiency

- Data sovereignty over vendor convenience

- Compliance certainty over cost optimization

What This Means for Enterprise Architecture

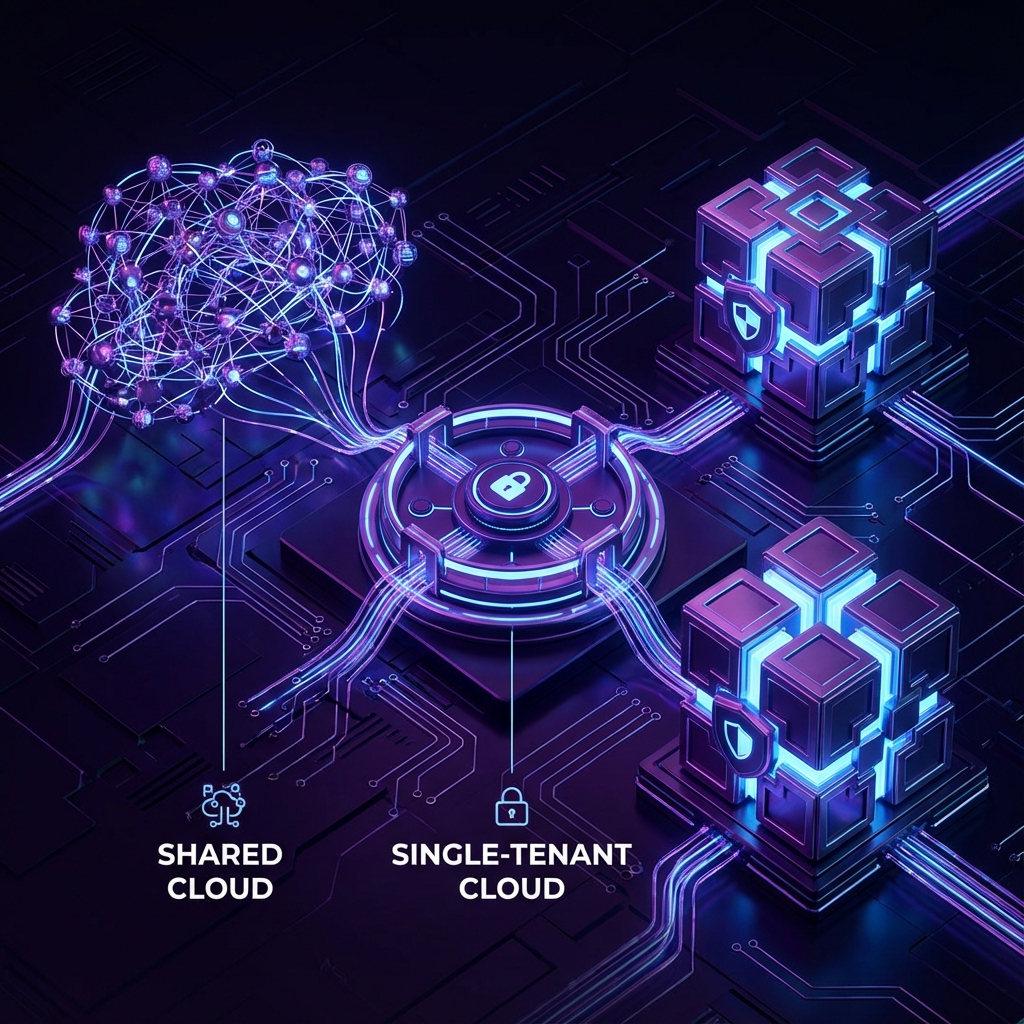

Shift 1: Multi-Sovereign by Default

Old Model: Single cloud provider, global deployment, unified infrastructure

New Model: Multi-region, multi-sovereign, federated architecture

Implications:

- Architecture must support regional deployment variations

- Data classification becomes mandatory at ingestion

- Cross-border data flows require explicit governance

Shift 2: On-Premise Renaissance

The air-gapped data center is no longer "legacy"—it's strategic:

Why On-Premise is Returning:

- Complete jurisdictional control

- No dependency on cloud provider terms of service

- Protection from extraterritorial legal access

- Elimination of egress costs at scale

Modern On-Premise ≠ Legacy On-Premise:

- Apple Silicon and efficient GPU clusters

- Containerized, cloud-native architectures running locally

- Modern observability and management tooling

- Hybrid connectivity where appropriate

Shift 3: Model Independence

The Risk: Dependency on a single model provider (OpenAI, Anthropic, Google) creates:

- Pricing power imbalance

- Terms of service vulnerability

- Single point of compliance failure

- Geopolitical exposure

The Response:

- Open-weight models (Llama, Mistral, Qwen) for core workloads

- Multi-model architecture for resilience

- Local inference capability for sensitive operations

- Commercial models only for specific, non-sensitive use cases

Architecture Implications

Knowledge Infrastructure Patterns

Pattern 1: Sovereign-First

┌─────────────────────────────────────────┐

│ SOVEREIGN BOUNDARY │

│ ┌─────────────┐ ┌─────────────────┐ │

│ │ Local LLM │ │ Private Vector │ │

│ │ (Llama/etc) │ │ Database │ │

│ └─────────────┘ └─────────────────┘ │

│ │ │ │

│ └───────┬───────┘ │

│ ▼ │

│ ┌────────────────────────────────────┐│

│ │ RAG Application Layer ││

│ └────────────────────────────────────┘│

└─────────────────────────────────────────┘

Pattern 2: Hybrid Sovereign

┌─────────────────────────────────────────┐

│ SOVEREIGN BOUNDARY │

│ ┌─────────────┐ ┌─────────────────┐ │

│ │ Sensitive │ │ Confidential │ │

│ │ Processing │ │ Documents │ │

│ └─────────────┘ └─────────────────┘ │

└─────────────────────────────────────────┘

│

│ Secure Gateway (Filtered)

▼

┌─────────────────────────────────────────┐

│ REGIONAL CLOUD │

│ ┌─────────────┐ ┌─────────────────┐ │

│ │ General │ │ Non-Sensitive │ │

│ │ Inference │ │ Documents │ │

│ └─────────────┘ └─────────────────┘ │

└─────────────────────────────────────────┘

Pattern 3: Multi-Sovereign Federation

┌─────────────────┐ ┌─────────────────┐

│ SINGAPORE │ │ EUROPE │

│ ┌───────────┐ │ │ ┌───────────┐ │

│ │ APAC Data │ │ │ │ EU Data │ │

│ │ + Compute │ │ │ │ + Compute │ │

│ └───────────┘ │ │ └───────────┘ │

└────────┬────────┘ └────────┬────────┘

│ │

└────────┬───────────┘

▼

┌─────────────────┐

│ Federated Query │

│ Orchestration │

└─────────────────┘

Vendor Strategy Adjustments

Questions to Ask Your AI Vendor:

- Data residency: Where exactly does my data reside and process?

- Model location: Where does inference computation occur?

- Subprocessors: Who has access to my data downstream?

- Contractual protections: What happens if terms change?

- Exit strategy: How do I migrate to alternatives?

Red Flags:

- Vague data location promises ("our global network")

- Training on customer data by default

- Limited contractual protections

- No offline or self-hosted options

Procurement Framework Adjustments

Traditional Evaluation Criteria:

- Feature completeness

- Price

- Integration ease

- Vendor stability

Sovereign-Adjusted Criteria:

- Data sovereignty guarantees

- Jurisdictional flexibility

- Model independence / portability

- Contractual protections

- Feature completeness

- Price

Planning for 2026-2028

Near-Term Actions (Next 6 Months)

-

Audit Current State

- Where does your AI data flow today?

- What contractual protections exist?

- What compliance gaps need addressing?

-

Classify Your Data

- What requires sovereign treatment?

- What can remain on public cloud?

- What needs air-gapped protection?

-

Assess Vendor Exposure

- Single vendor dependencies?

- Terms of service vulnerabilities?

- Geopolitical exposure?

Medium-Term Strategy (6-18 Months)

-

Architecture Evolution

- Implement data classification at ingestion

- Build sovereign deployment capabilities

- Establish multi-model flexibility

-

Vendor Diversification

- Reduce single-vendor dependency

- Build internal model serving capability

- Negotiate improved contractual terms

-

Compliance Preparation

- Anticipate regulatory evolution

- Build audit-ready infrastructure

- Document compliance posture

Long-Term Positioning (18-36 Months)

-

Strategic Infrastructure

- On-premise capability for sensitive workloads

- Regional deployment flexibility

- Complete model independence option

-

Competitive Advantage

- Sovereign AI as customer feature

- Compliance-first sales positioning

- Reduced regulatory friction

The Enterprise Decision Framework

When Sovereign-First Makes Sense

High Indicators:

- Regulated industry (financial services, healthcare, defense)

- Personal data at scale

- Trade secrets or proprietary methodologies

- Cross-border operations in strict jurisdictions

- Government or public sector clients

Medium Indicators:

- B2B enterprise customers with data requirements

- Competitive industries with IP concerns

- International operations

- High-value transaction data

Lower Indicators:

- Pure B2C with standard data

- Public information processing

- Non-regulated industries

- Single-jurisdiction operations

Cost-Benefit Analysis

Sovereign Infrastructure Costs:

- Higher initial infrastructure investment

- Potentially higher per-inference costs

- Additional operational complexity

- Specialized talent requirements

Sovereign Infrastructure Benefits:

- Complete compliance certainty

- Elimination of vendor lock-in risk

- Protection from terms of service changes

- Competitive differentiation

- Reduced long-term pricing exposure

Next Steps

For enterprises planning knowledge infrastructure strategy:

- Current State Assessment: Audit your AI data flows and vendor dependencies

- Sovereign Readiness Review: Evaluate your architecture against emerging requirements

- Roadmap Development: Plan your evolution toward sovereign capability

Schedule Strategy Review | Explore Sovereign Options

Related reading: