Sovereign AI for Family Offices

The digital transformation of family office operations has reached an inflection point. As generational wealth increasingly depends on institutional knowledge—investment theses, relationship histories, deal precedents—the question is no longer whether to digitize, but how to do it without creating existential risk.

For families managing $100M+ in assets, the stakes are not abstract. A leaked investment strategy. An exposed family dispute. A compromised succession plan. These are not IT problems. They are legacy-destroying events.

This guide addresses the architectural requirements for deploying AI-powered knowledge systems within the sovereignty constraints that serious family offices demand.

The Family Office Knowledge Problem

What Family Offices Actually Need to Manage

Unlike institutional investors, family offices operate across an unusually broad knowledge domain:

Investment Intelligence

- Deal flow and sourcing relationships

- Due diligence documentation across asset classes

- Investment committee deliberations and rationale

- Performance attribution and lessons learned

Family Governance

- Trust and estate documentation

- Succession plans and contingency scenarios

- Family constitution and governance protocols

- Beneficiary information and preferences

Operational Knowledge

- Vendor relationships and contract terms

- Property management and maintenance histories

- Staff protocols and institutional procedures

- Insurance policies and claims histories

Relationship Capital

- Advisor networks and engagement histories

- Co-investment partner relationships

- Philanthropic commitments and impact tracking

- Multi-generational contact databases

The challenge: This knowledge is scattered across email threads, shared drives, legal documents, and—most critically—the memories of key personnel. When a trusted advisor retires or a principal passes, decades of institutional knowledge can vanish overnight.

Why Public Cloud AI is Structurally Unsuitable

The Terms of Service Reality

When you use ChatGPT, Claude, or Gemini for family office queries, consider the data flow:

- Your query travels to a third-party data center

- It is processed on shared infrastructure

- It may be logged, analyzed, or used for model training

- It persists in systems you do not control

For a query like "Summarize our succession plan for the Singapore properties," this data path creates unacceptable exposure.

The Regulatory Dimension

Family offices handling Singapore-based assets must consider:

- PDPA (Personal Data Protection Act): Requires consent for personal data transfer and processing

- Banking Secrecy Act: Prohibits disclosure of customer information without consent

- Trust Law: Fiduciary duties that may conflict with third-party data processing

A family office that routes beneficiary information through US-based AI providers may be violating multiple regulatory frameworks simultaneously—often without realizing it.

The Counterparty Risk

Even with enterprise agreements, public AI providers represent concentrated counterparty risk:

- Data breach at provider level exposes all clients

- Subpoena or legal discovery in provider's jurisdiction

- Provider acquisition or bankruptcy creates data custody uncertainty

- Terms of service changes with limited recourse

For families accustomed to Swiss banking discretion, this exposure profile is fundamentally misaligned.

Sovereign Architecture for Family Office AI

Defining Sovereignty

In the context of family office AI, sovereignty means:

- Data Residency: All data remains within jurisdictions you select

- Processing Isolation: No shared compute infrastructure

- Model Independence: No external model training on your data

- Physical Control: Option for on-premise deployment

- Audit Authority: Complete visibility into all system access

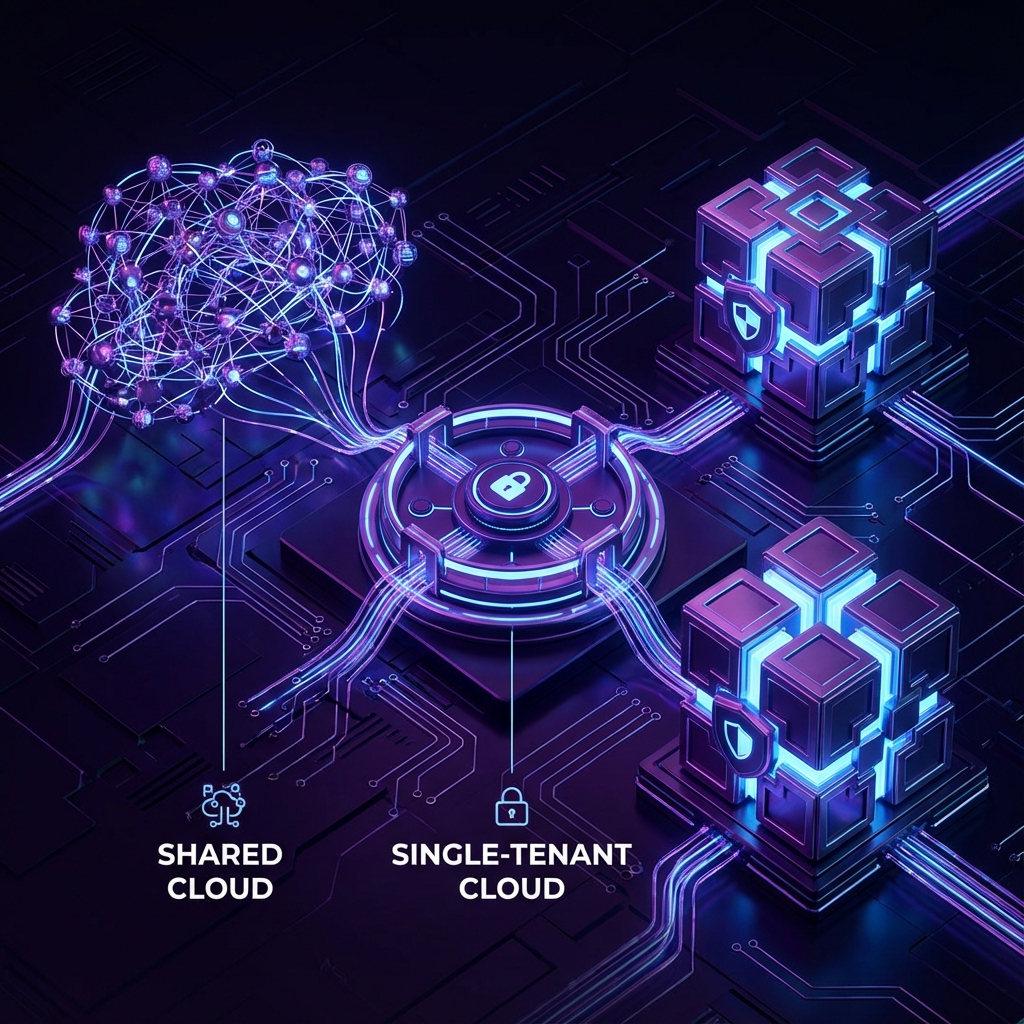

Deployment Options

Option 1: Private Cloud Instance (Singapore)

Architecture:

- Dedicated Cloudflare/Azure instance in Singapore

- Single-tenant isolation at the infrastructure level

- TLS encryption in transit, AES-256 at rest

- Access restricted to your IP whitelist

Deployment timeline: 24-48 hours Best for: Family offices requiring compliance without hardware management

Option 2: Sovereign Air-Gap (On-Premise)

Architecture:

- Apple Silicon M2/M3 Ultra or NVIDIA GPU cluster

- Physically deployed in your premises

- Zero internet connectivity

- Manual updates via secure transfer

Deployment timeline: 2-4 weeks Best for: Single-family offices, "war room" scenarios, maximum discretion

Technical Requirements

Private Cloud Minimum:

- Dedicated compute allocation (8 vCPU, 32GB RAM minimum)

- Private vector database (Pinecone/Weaviate single-tenant)

- Azure OpenAI via private endpoints

- Cloudflare Zero Trust access controls

Air-Gap Minimum:

- Apple M2 Ultra (128GB RAM) or NVIDIA A100

- Local Llama 3 or Mistral deployment

- On-device vector storage (Qdrant/Chroma)

- USB-based secure update mechanism

Implementation: The Family Office RAG Stack

Document Ingestion Pipeline

Family office documentation typically includes:

| Document Type | Volume | Sensitivity |

|---|---|---|

| Trust instruments | 50-200 pages | Maximum |

| Investment memos | 500-2000 pages | High |

| Meeting minutes | 1000+ pages | High |

| Correspondence | 10,000+ emails | Variable |

| Property records | 200-500 pages | Medium |

The ingestion pipeline must handle:

- PDF parsing (including scanned documents with OCR)

- Email thread reconstruction

- Metadata preservation (dates, authors, recipients)

- Access control inheritance from source systems

Knowledge Retrieval Design

For family office use cases, retrieval must balance:

Precision over recall: A query about "Singapore property succession" must not surface US trust documents, even if semantically similar

Temporal awareness: "Current" beneficiary status differs from historical records

Relationship mapping: Understanding that "John's advisor" may refer to different people across decades

Confidentiality zoning: Some documents restricted to principals only; others available to staff

Query Patterns

Typical family office queries include:

Investment Research

- "What was our investment thesis for the 2019 XYZ Fund allocation?"

- "Summarize all co-investments with [Partner Name]"

- "What concerns did the investment committee raise about real estate in Q3 2024?"

Governance Support

- "What does the family constitution say about major capital decisions?"

- "Summarize the succession plan for the operating businesses"

- "What are the distribution requirements for Trust A?"

Operational Queries

- "When was the Monaco property last appraised?"

- "What is our contract renewal date with [Advisor Name]?"

- "Summarize all insurance claims in the past 5 years"

Security Architecture

Access Control Model

Family office AI requires hierarchical access control:

Principal Level: Full access to all knowledge Family Executive: Investment and governance documents Investment Team: Investment-related documents only Operations Staff: Operational documents only External Advisors: Specific document sets by engagement

Implementation requires:

- Document-level permission tagging

- Query filtering based on user role

- Audit logging of all access

- Session management with automatic timeout

Audit and Compliance

Every query must produce an audit record:

{

"timestamp": "2026-01-01T14:30:00Z",

"user": "j.smith@familyoffice.com",

"query": "Summarize Singapore property succession",

"documents_accessed": ["trust-sg-001", "trust-sg-002"],

"response_tokens": 450,

"access_level": "principal"

}

This enables:

- Compliance reporting for regulators

- Internal audit reviews

- Anomaly detection for unauthorized access

- Query pattern analysis for system improvement

Case Study: Single Family Office Implementation

Context

- $500M AUM single-family office

- Principal transitioning to next generation

- 30 years of accumulated documentation

- Concerns about advisor dependence

Deployment

- Private cloud instance (Singapore)

- 15,000 documents ingested

- 4 access levels configured

- Integration with existing document management

Results (6 months)

- 70% reduction in time to locate historical documents

- Succession planning accelerated by 3 months

- New family member onboarded in 2 weeks vs. typical 3 months

- Zero security incidents

Key Learning

The highest-value queries were not investment-related. They were governance and relationship queries that previously required calling retired advisors or searching through decades of email.

Getting Started

Phase 1: Knowledge Audit (Week 1-2)

- Inventory all document repositories

- Classify by sensitivity and access requirements

- Identify key knowledge gaps and dependencies

Phase 2: Architecture Design (Week 2-3)

- Select deployment model (private cloud vs. air-gap)

- Define access control hierarchy

- Design ingestion and update workflows

Phase 3: Pilot Deployment (Week 3-4)

- Deploy with limited document set

- Test queries with key stakeholders

- Refine retrieval and access controls

Phase 4: Production Rollout (Week 4-6)

- Complete document ingestion

- User training and adoption

- Ongoing monitoring and optimization

Next Steps

For family offices evaluating sovereign AI infrastructure:

- Security Review: We provide detailed architecture documentation for your security and legal teams

- Pilot Scope Definition: Identify 500-1000 documents for initial deployment

- Architecture Consultation: Technical review of your current systems and integration requirements

Schedule Architecture Review | Explore Private Cloud Pilot

Related reading: